跨世支付有限公司

EnterWTO Payment Services Provider

- …

跨世支付有限公司

EnterWTO Payment Services Provider

- …

EnterWTO Payment Services Provider (EnterWTO) has been established since 21/06/2004. We are fintech company, specialized in providing the innovative e-payment solutions with coverage of 4,000 China banks,BaaS & SaaS, powered by our self-invented Breaking Language Barrier patent (Reg.No.:500/2016). Our whitelabel C2C, C2B,B2C and B2B Merchant Console and API are professionally designed with automated updated Sanction & SDN and PEP screening and ongoing monitoring supported by the regulators.

Because of the complexity and strictness of China currency restriction policies, there are many illegitimate USD & CNY payments solutions in the markets due to the misinterpretation of China law and regulations, some well-known financial institutions, even some foreign supervision departments are unable to define what legitimate USD & CNY remittance or payment products are under today's severe AML trend , the most compliance officers and legal due diligence auditors have got no ideas about China-inbound /Outbound C2C and B2B Payments, China related payments have become very challenging year-after-year.

EnterWTO has always dedicated our rich experiences and knowledge to the payment industry enthusiastically,we are well-recognized by our partners and clients.

In compliance with International Financial Anti-money Laundering and Anti-scamming,EnterWTO as a fintech has registered with Financial Crimes Enforcement Network Department of the Treasury of US (Known as FINCEN,Reg.:31000214695334) and State Administration of Foreign Exchange of China (known as SAFE, Ref:361450728),to ensure our BaaS & SaaS are professional programmed to meet the enhenced compliance required year-after-year from our valued clients worldwide.

Our Products & Services are listed as below:

AED Bank-to-Bank Distribution Portal

AED Payment Portal through International BaaS from Low-Risk country to minimise various expenses. WhatsAPP me

Multi-currency Named Account Solution

Customization of the sender's information through Named Account Payment Portal per supplier or its bank requirement.WhatsAPP me

E-commerce Site Acquiring Solution

Company Formation with online e-commerce website setup including Bank Account(s) ,and online Visa & MasterCards Acquiring Serices.WhatsAPP me

Online Cardless Payment Collection

Payments collections to low-risk country bank account(s) through E-invoice or online OTP verification for your banker's preference. WhatsAPP me

Large-commodity & Precious Metal Settlement

Client DueDiligence vs your trade partner(s) and Bank Instruments Custodial Related Services for Large-commodity Trading upon request. WhatsAPP me

E-Pyament Patent Subscription

Self-invented Breaking Language Barrier patent (Reg.No.:500/2016) Technology to overcome the language barrier in daily transaction needs. WhatsAPP me

※ First-mover Advantage

Our team members with rich 20-year experiences have been recognized by Finacial Service Industry. We are capable in matching end-to-end bank preferred services up as a bespoke, innovative product for our clients imposed by on-going fine-cultivation, well-coordination with the participants. We are a truly China payment solution experts.

※ Professionalism

We have kept adopting C2C, B2C, B2B China payment official channels through various attempts with the valuable user-experience feedbacks for product and service improvements. We always well-coordinate with our partner banks and frontline service agents with a dream of building an one-stop-for-all for the diversified community.

※ Advance Banking Channels

We are benefited from our long-term goodwill, trustworthiness, and strong implementation of AML procedures, our business is supported by various banking service providers, it is our obligation to achieve the preferred businesses for multi-party common interest. We are the hub of the marketing information, where the demand is, to where EnterWTO would present.

※Fully Regulated

We aware of the supervision framework with respect and strict implementation. Our products are applied two-ends CDD procedures for sustainable development with renouncement of cash transactions and high-risk clients, narrowed the profits but business last longer. Our products and services have been full reviewed and passed all the inspections launched periodically by the regulators.

※ Business Model

Our products and services are limited for the regulated financial institutions with Bank-to-Bank settlement mode only, each transaction is monitored and sceened by the automated KYC system. Our valued financial partners have no worry about the leackage of customer informatio or commercial losses, because EnterWTO is BaaS & SaaS Provider.

※ Tech-advantage

EnterWTO has adopted the advance technology for product innovation with our self-invented Breaking Language Patent Technology to fulfill today’s IT modernization. Every single transaction must go through more than 20 procedures through the Settlement of Foreign Exchange with real-time distribution client fund.

成功案例

案例一

多币H5红包 — 跨境多币红包这是一款弘扬中华名族礼仪,通过微信或其他即时通讯平台小程序生成小额礼仪红包、慰问白包,商贸结算,传播礼仪红包。该产品接近零成本的市场营销工具。

特色一:7x24收结汇。当收款/受惠人需要提现到中国银联卡时,则需补充所缺失的收款人资料,进行收款账户有效自助认证,验证通过后资金即时(节假日)收、结汇到账。

特色二:通过合作多家商业银行及地方政府特殊政策,多币红包在因私无因结合赡家款每天可结汇等值8万元人民币,年度因私结汇可达到12万美元,不包括高薪族备案后特批结汇。

案例二

同名账户代付解决方案 — 出口核销对SWIFT报文格式、结算方式要求。本方案是通过SWIFT报文形式并以真实汇款身份汇入指定收款个人或公司账户,以便满足退税及内外财务管理要求,此举解决了收款行合规审核流程、以解决阁下后顾之忧。跨世支付还提供多币代付平台和接口,该产方案有如下特色:

特色一 C2C 外币代付

※到账时间快

※中国境内免中行费用

※无因性代付

特色二 B2B 外币代付

※到账时间快

※中国境内免中间行费用

※因公有因代付(善用简化尽调通道)

案例三

网上支付中文录入专利 — 跨世在线电子支付专利是一款当付/汇款人不能提供全部收款人信息情况下,能够打破各国语言障碍的电子支付专利,专利号:500/2016,适用于在线支付和网银系统。

特色一

当付/汇款人不能提供全部收款人信息情况下,能够打破各国语言障碍的电子支付专利,适用于个人在线人民币收付。

特色二:人民币的在线支付和网银转账业务难以与国际市场接轨,阻碍了人民 币全球化进程。 跨世支付专利将令全球收付先小额后大额畅通无阻。

防患诈骗与洗钱案例共享

专家诊断解答

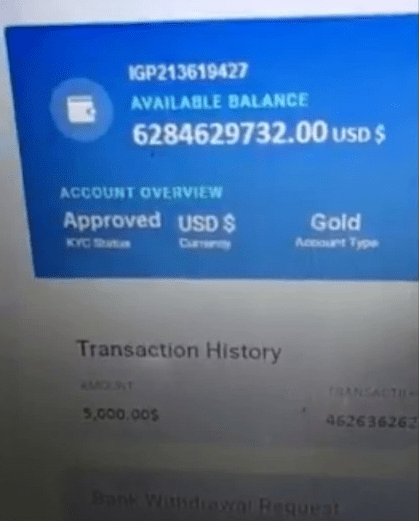

仿冒互联网银行行骗案

诈骗分子仿造某某Pay的钱包,”网银“交易为同行转账交易详情。为了证明网银属于”自己“的,网银的账户也被设计成与在其绑定一张正常银行卡号完全一致,并且提供”自己“ 的假护照,旨在证明本人本卡本人持有的网银,并承诺交易成功后,支付交易对家40% 套现金额作为回报。

如受骗人/公司因贪心在利益诱惑之下测试卡资金是否可用,就刚好中了诈骗分子的圈套,因为钱包所绑定的借记卡是一种其他银行发行正常银行卡。一旦测试成功后,就想当然认为被消费资金来自该”网银“的余额,就会信以为真。

接着,诈骗分子会以方便到账为名,让即将受骗人在同一钱包应用注册账户,其借口是让转入资金或数字资产秒到或在较短时间内限账,这种所谓同行转账是为了让目标受害人在最短时间内进行结算,貌似无懈可击..........

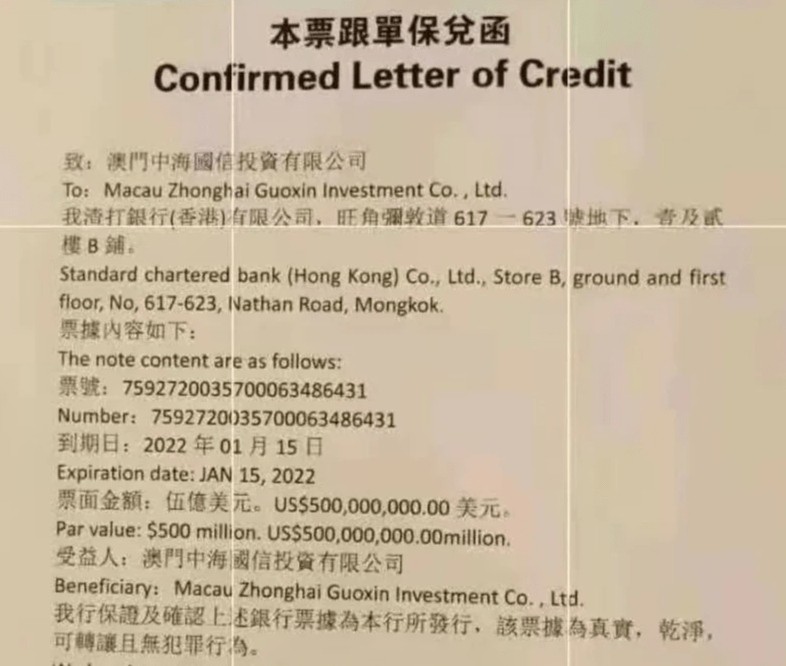

伪造香港渣打银行保函

2021年8月中旬,某某贸易促进会的诉求,要求将一张远期本票跟单保兑函(Confirmed Letter of Credit)贴现, 开票主体为某某联网云分享有限公司。起息日:2022年1月15日,票面金额为:5亿美元,后续还有来自几张相对小额保兑函,开证银行为:香港渣打银行。破绽:

1. 渣打银行的办公座机为“5” 字头号码;2. 在保兑函上的渣打银行官网地址被替换。3.从某某公司支票号码序号连贯性来分析,该司没有为其他业务签发支票,跨世从来自不同诈骗分子的保兑函支票号码以及签名发现更多破。4. 从支票的序号开票金额来分析,开票主体有意将支票金额从原来的5亿美元减少到5千万美元,降幅是原来的10倍,目的认为减低额度后跟容易成交。5.开证签名人将自己的签名错签在渣打银行的位置上,可以看出作案者不知道香港开票/证的格式,导致把模仿签名落到银行官票据签名位置上.......

确认:以上所谓的银行跟单保兑函是伪造。

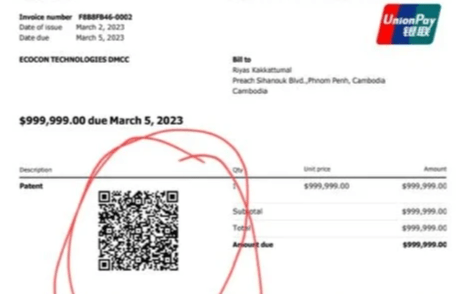

伪造国际云闪付诱骗

云闪付是华人华侨耳熟能详的中国品牌,照样成为诈骗分子的目标,黑市电子发票上扫码40-50%作为回报。

鉴于云闪付在过往有类似失误修复等报道,受害人/公司因贪婪宁可信以真,并以为可以不劳而获,接下来会按诈骗分子的”指导“去租/借所谓匹配或指定的POS机,或实名注册某某钱包,在这样一步步中了圈套,当受骗人或公司往往向POS机提供方支付了保证金/租金/担保金后或往某某钱包存入一笔账户激活费后,诈骗分子就从消失了....

一旦有人上钩,自然以上的二维码刷不到一分钱。

联系我们

P.O. Box: 4068, Office No.2204-059, 20th Floor, Invox Business Centre,Twin Towers, Al Rigga Distrct,Dubai, UAEhttps://api.whatsapp.com/send/?phone=971505587198&text&type=phone_number&app_absent=0+971 4 2626711 / +971 50 5587198

Address:P.O. Box: 4068, Office No.2204-059, 20th Floor, Invox Business Centre,Twin Towers, Al Riqqa District, Dubai, United Arab Emirates

Tel: +971 4 2626711/ +971 505587198

Email: kyc@EnterWTO.com